What is Escrow and Why it's Important

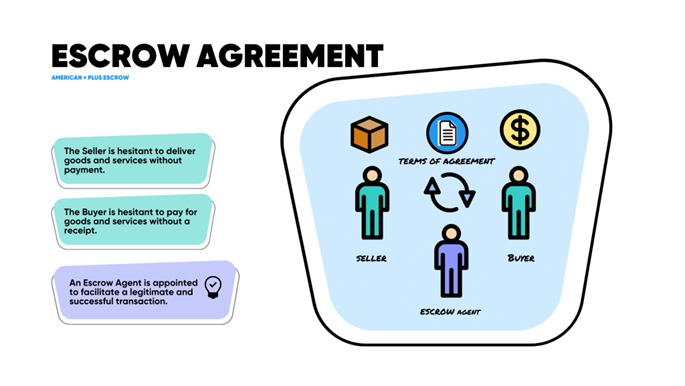

You will require at some point in your financial life, the help of an escrow account, especially in today’s digital economy. Escrow is primarily a temporary pass-through account held by a third party to facilitate a smooth buying process between buyer and seller. This mode of transaction has been around for ages but it’s gaining new popularity as the safest way to transact online.

At a very basic level, an escrow bank account is all about efficient risk management, simplification of complex transactions and prudent custody of cash, securities and other collaterals. And in the new world of online finance, buying and selling through escrow is now more important than ever and here’s why —

4 Key Benefits of Escrow

Escrow accounts offer a few advantages over any other banking service. Firstly, escrows are able to provide a safe and secure mode of managing cash flows for all parties. Secondly, an escrow account allows transactions to be customized to suit the requirements of both buyer and seller. Thirdly, banks allow opening and operating multiple accounts for ongoing transactions to support business supply chains.

Lastly, an escrow bank account allows simplified documentation and online tracking.

1. It’s Smart Business

An escrow account maintains regular or irregular payment intervals but never in a lump sum to help you manage cash flow. Small and medium-sized firms rely on escrow bank accounts for receivables purchase and invoice discounting.

Typical transactions also include revenue-sharing escrows for joint ventures, milestone escrows linked to performance and or any obligation, escrows for franchisor-franchisee and anchor-dealer model, e-tendering-linked escrows, and transactions that require a secure mode of settlement through an escrow structure. All in all, these transactions are essential to a business’ financial health.

2. It Accommodates Special Financial Requirements

In the world of mergers and acquisitions (M&A), deals involve large sums of money at different stages of the process. Complex financial requirements such as share-purchase transaction-linked escrows, FDI-linked share-purchase escrows, open offer escrows, and escrows for indemnity obligations, are necessary for closing the deal. Buyback offer escrows and delisting offer escrows, for example, are valuable currency to promoters offering shareholding from willing parties.

3. It Facilitates Easy Investment and Lending

Escrow is commonly associated with real estate. If you’re investing in or selling real property, you’ll likely hear about escrow as a requirement for managing funds after an offer has been accepted on a home sale. Escrow is still the gold standard for handling earnest money, distribution of funds at closing, and payments for property taxes and insurance by mortgage servicers because it offers the most significant protection for homebuyers and mortgage lenders.

When it comes to lending money, escrow accounts are reliable and backed by real cash value. Finance companies offering retail public issue of debt instruments, are able to service lending obligations through escrow. Discerning corporate entities prefer it due to low global interest rates which encourages them to acquire more external, commercial borrowing-linked escrows.

4. It’s the Safest Way to Transact Online

Opening an escrow account is the simplest way to collect payments to your website, mobile app, online store, classified site or marketplace. It’s also easy, convenient and safe for your customer to complete the buying process online. It helps you establish credibility when customers know that your online enterprise is backed by a trusted escrow.

Protect Your Finances With Escrow

From the purchase and sale of a single family homes, vehicles, seller carry backs, cash purchases, investments, commercial sales, short sales, reverse mortgages, refinances, loan modifications, loan forbearance, deed in lieu, title transfers, notary service and more — we'll safeguard your transactions with American Plus Escrow.

Book a call with an Escrow Manager today.