Your Basic Guide to Earnest Money Deposit (EMD) in Real Estate

What is an Earnest Money Deposit? Can you protect it from sellers acting in bad faith? And how much is enough?

In today’s highly competitive housing market, it is important to make sure that your offer stands out. There are ways to show serious interest in buying a certain property, such as presenting a pre-approved loan document from a lender. But the most compelling of all is putting down an Earnest Money Deposit.

This is a quick guide to understanding what an Earnest Money Deposit is, how to use it to your advantage when buying a house and how to protect and refund it, if necessary.

What Is Earnest Money In Real Estate?

An Earnest Money Deposit is a form of security deposit on a property to indicate that the buyer is serious about completing its purchase. It's also known as a good faith deposit — giving the buyer extra time to get financing and conduct the title search, property appraisal, and inspections before closing.

Why Is Earnest Money Important?

Earnest Money secures the buyer’s interest by decreasing the likelihood of other buyers placing offers on the same property. It also protects the seller if the buyer backs out of the deal after the property is taken off the market.

If the deal goes smoothly, the earnest money is applied to the buyer's down payment or closing costs. However, if the deal falls through due to a failed home inspection or any unmet contingency in the Purchase Agreement, the buyer gets their earnest money back.

How Much Earnest Money Deposit Should Be Paid?

The amount of Earnest Money Deposit could range from 1% to 10% of the final purchase price depending on market demands and the condition of the property. A high-value property on a prime location in a bullish real estate market, can command the highest possible deposit amount in a bidding war, while a run-down fixer-upper in a sluggish market does not.

In some cases, property sellers establish a fixed deposit amount in order to weed out speculators who aren't really interested in buying.

How Does Earnest Money Deposit Work?

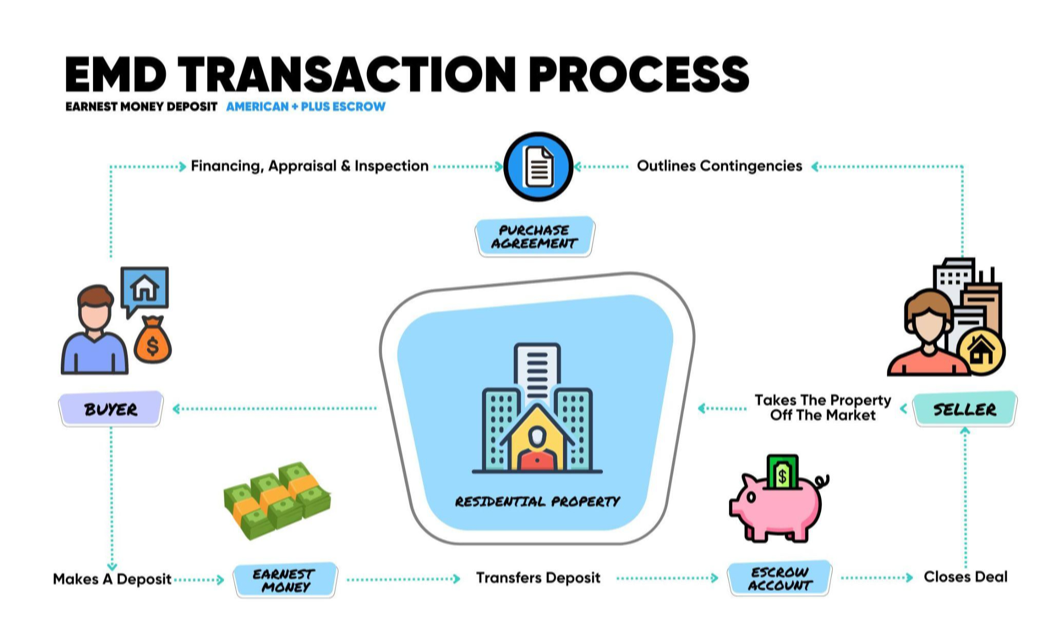

To secure a property deal, the buyer makes an Earnest Money Deposit into an escrow account or trust held by someone else, such as a law firm, real estate broker, or title company. Wire transfer, personal check, and certified check are all acceptable forms of payment.

When a buyer and seller enter into a Purchase Agreement, the seller takes the home off the market to initiate the entire buying process. The earnest money is held in an escrow or trust account until the transaction is completed.

If the deal falls through, the seller has to relist the home and start all over again, which could result in a big financial loss

Transaction Process:

Both buyer and seller sign a Purchase Agreement, stating the contingencies involved in a real estate deal. It also ensures the buyer that the property is up to the market standards in all aspects.

The buyer pays the Earnest Money Deposit to the seller to show they are committed to closing the deal. A real estate broker or a title company holds the deposit in an escrow or trust account.

The amount of Earnest Money Deposit is negotiable and could be a percentage (1-3%) or a fixed amount of the property’s purchase price, depending on the housing market demand and the property value.

After paying the Earnest Money Deposit, the buyer can inspect and appraise the property within the contingency period.

If the value of the property is less than the asked price upon inspection, the buyer has the option to back out of the deal.

If the property fails to meet inspections, i.e. pests, weather and structural damage to the property, the buyer has cause to turn down the deal and get their deposit back.

If the contingency period is over and the buyer backs off at the last minute, the seller can keep that deposit amount and use it as compensation against the fake guarantee.

Is Earnest Deposit Money Part Of The Purchase Price?

Yes. An Earnest Money Deposit is computed as part of the final purchase price. When earnest money is offered in a contract of sale, it shall be regarded as evidence of the contract's fulfillment.

Is Earnest Money Refundable?

It depends. Earnest Money Deposit is for the most part, considered a refundable security deposit IF the contingencies in the Purchase Agreement are not met. The Purchase Agreement outlines contingencies to protect the buyer from getting involved in a bad deal after paying the deposit. The buyer should take action within the contingency schedule otherwise, the deposit is retained by the seller.

What Are The Types of Contingencies In A Purchase Agreement?

Appraisal Contingency

If the buyer finds that the selling price of the property is more than what it should cost based on its condition, they can cancel the deal and get a refund.

Inspection Contingency

The buyer is free to get the property inspected against structural issues or termites. If the property does not meet inspection requirements, the buyer is free to cancel the agreement and get a refund.

Financing Contingency

If the buyer’s loan application or lending decision remains pending for any reason (other than something that the buyer is accountable for), they can cancel the Purchase Agreement and get their Earnest Money Deposit back.

How Can A Buyer Protect Their Earnest Money?

The buyer can take the following steps to ensure their escrow deposit preserved and refunded when required:

Have a Purchase Agreement prepared and signed by both parties without fail. Make sure it mentions financing, appraisal, and inspection contingencies.

Buyers must be mindful of property appraisal and inspection deadlines stipulated in the Purchase Agreement.

There must be an Escrow Account held by a third party like a real estate broker or title or settlement company that will store the token money.

All decisions related to property purchase should be made before the deadline, especially if it is about canceling the deal.

Keep the contract clauses in written form. Relying on verbal agreements could be dangerous even if the seller is someone very close.

Get Help with Escrow

Before you make an Earnest Money Deposit on a property you’re eager to buy, first, you must refer to this document sample from C.A.R. to understand the details of a Purchase Agreement With Escrow. This guidance will help you avoid potential pitfalls as you go about acquiring property. If you’re interested in finding out more about refinancing, selling or purchasing a new home contact us at American Plus Escrow for a free consultation.